Saule Omarova, then a professor at Cornell Law School in 2021, faced one of the most intense nomination processes in recent history. The specter of her near nomination still haunts the halls of Congress. Yet now that President Donald Trump has nominated his own candidate for the head of the Federal Reserve, it seems like a double standard has emerged.

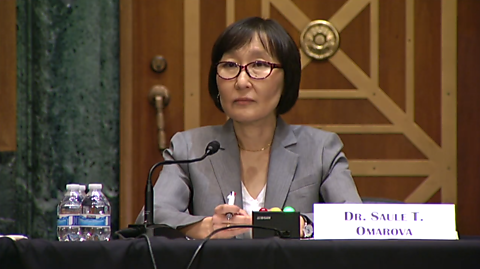

Omarova was nominated by President Joe Biden to lead the Office of the Comptroller of the Currency (OCC). As if the length of the name wasn’t enough to keep the agency out of the headlines, its actions also tend to run under the radar (Figure 1). For anyone unfamiliar, the OCC is responsible for chartering, regulating, and supervising national banks, federal savings associations, and similar entities.

Yet, Omarova’s nomination quickly became one of the biggest dramas in Washington, DC, back in 2021. Government officials, policy analysts, and political commentators quickly went on the offensive when her nomination was announced.

“I don’t know whether to call you professor or comrade.” – Senator John Kennedy (R‑LA)

“President Biden wants to fill [the position] with an activist intellectual who is—and I say this in the kindest way possible—a nut.” – Matthew Continetti, American Enterprise Institute

“Sticky fingers Omarova was caught shoplifting at TJMaxx [36 years ago]. Now she’s Biden’s OCC nom and wants to end private banking and steal your money.” – Catherine Austin Fitts, Solari

To be clear, I feel bad that Omarova had to face personal attacks, but that doesn’t mean I agree with her policy recommendations. In fact, I’d say I disagree with nearly all of them (e.g., creating a central bank digital currency (CBDC)). However, as my colleague George Selgin demonstrated at the time, it is possible to critique someone’s ideas without resorting to personal attacks.

With that said, what makes this situation strange is that a double standard is emerging between Omarova and President Trump’s nominee for Federal Reserve Chair. Much of the criticism for Omarova was targeted at something she did in school while growing up in the former Soviet Union, but Kevin Warsh seems to be getting a free pass on something he wrote just a few years ago in the Wall Street Journal.

Like Omarova, Warsh explicitly called for the creation of central bank digital currency (CBDC). The only difference is that Omarova called for a retail CBDC for consumers while Warsh called for a wholesale CBDC for banks. Between the two forms, a wholesale CBDC is the better option.

However, the best option is no CBDC at all.

Omarova’s experience suggests that Warsh’s proposal would have been a concern, yet Warsh has received a warm welcome from Republicans.

“Kevin Warsh is a brilliant pick by President Trump for Fed Chair. Clear from what he wrote in 2021 he understands the scale of China’s ambitions. As a member of the Banking Committee I look forward to working with him to maintain American financial supremacy.” – Senator Jim Banks (R‑IN)

“Now more than ever, we need a Federal Reserve that embraces digital assets and financial innovation…. I applaud President Trump’s decisions…” – Senator Cynthia Lummis (R‑WY)

“No one is better suited to steer the Fed and refocus our central bank on its core statutory mandate.” – Senator Bill Hargerty (R‑TN)

I’m not suggesting members of Congress should attack Warsh’s character. They should not. However, they shouldn’t ignore his statements, either. When they meet with Warsh, the questions should be simple and straight to the point.

- The American people, Congress, and President Trump have taken a firm stance against a central bank digital currency (CBDC). Do you still stand by your argument that the United States needs to issue a wholesale CBDC?

- If not, were you wrong that a CBDC is needed to “strengthen the currency for a new era and bolster America as the leader of the global economic system”? Or were you wrong that China’s CBDC is a “[threat to] the dominance of the US dollar and American hegemony”?

- Federal Reserve Chair Jerome Powell suggested that a wholesale CBDC is unnecessary, considering it would look a lot like existing bank reserves. Given the state of bank reserves, advancements in the private sector, and the introduction of FedNow, do you agree with Chair Powell’s assessment?

As my colleagues, Norbert Michel and Jai Kedia, have pointed out, Warsh has done well in other areas. He was one of the first members of the Federal Reserve Board of Governors to criticize the Federal Reserve’s use of quantitative easing as a permanent monetary policy tool. Furthermore, he has expressed skepticism that the Federal Reserve is an all-powerful, all-knowing institution.

Still, that doesn’t mean Warsh should be given a free pass. He should be held accountable for the views he has expressed, just like all public officials. Congress should leave out the personal attacks, but Congress should not leave out the tough questions.